Am I Eligible for Hot Spot Tax Benefits?

As a startup in the Southern Tier of New York State, you could be eligible for NYSTAR Innovation Hot Spot or START-UP NY tax benefits. For information regarding Hot Spot benefits, read on!

What is a Hot Spot?

In 2013, New York State rolled out the Innovation Hot Spot Program to provide funding for business incubators and tax benefits for qualifying startups throughout the state. The Southern Tier Startup Alliance (STSA) became one of the ten designated “Hot Spots.”

Receiving tax benefits through this program also allows Empire State Development to connect startups to other New York State programs, like the NY Innovation Venture Capital Fund. More information about the Innovation Hot Spot program and its related opportunities can be found here. The Department of Taxation and Finance has a very helpful and detailed memo that further describes the program.

What are the Hot Spot tax benefits?

Hot Spot tax benefits are given to qualifying startups that are incubator members within one of the ten designated Hot Spots. Tax benefits include five-year exemptions from state corporate income tax and state sales tax on purchases.

In order to receive Hot Spot tax benefits, your company must meet basic qualification criteria for the program:

- You must be a member of an incubator within one of the ten Hot Spots,

- Your startup must be less than five years old or less than seven years old for life science companies, and

- Have less than $1 million per year in annual revenue.

See this page for a list of Hot Spot incubators. Partner incubators of the Southern Tier Startup Alliance are considered part of the Hot Spot program.

What is the Southern Tier Startup Alliance?

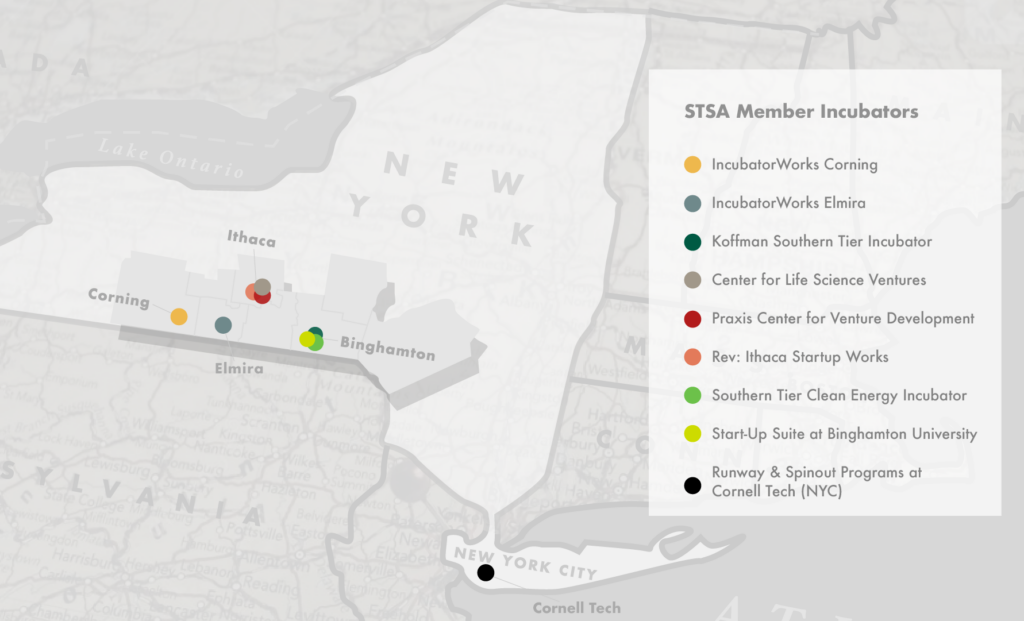

STSA is a collaboration between Cornell University, Binghamton University, and Corning Enterprises that aims to bolster the Southern Tier economy by increasing the number of jobs and diversifying the employment base. Driven by these commitments, STSA uses its funding to extend existing resources for entrepreneurs, and create new avenues of support as needed. STSA supports 9 incubators throughout the 8 counties that make up the Southern Tier of New York State:

- Koffman Southern Tier Incubator (Binghamton, NY)

- Southern Tier Clean Energy Incubator (Binghamton, NY)

- Start-up Suite at Binghamton University (Binghamton, NY)

- Rev: Ithaca Startup Works (Ithaca, NY)

- Center for Life Science Ventures at Cornell University (Ithaca, NY)

- Praxis Center for Venture Development (Ithaca, NY)

- IncubatorWorks (Corning, NY + Elmira, NY)

- Runway & Spinout Programs at Cornell Tech (New York, NY)

What are the benefits of belonging to a STSA incubator?

Incubators: Although STSA coordinates unique programming and networking events available to the public, members have access to exclusive mentorship from in-house Entrepreneurs-In-Residence, physical working spaces, and workshops. In addition to tax benefits potentially available to incubator members, the advantages of incubator support services correlate to startup success. According to the National Business Incubator Association, 87% of incubator graduates stay in business, as opposed to the 50-60% of startups that fail within their first five years nationally. To learn more about free entrepreneurship events open to the public, and to explore incubator membership, visit the STSA membership page.

The Southern Tier: With an astounding number of university students and faculty, and more engineering graduates than any other Upstate NY region, the Southern Tier is an economically viable area exceptionally positioned for collaboration, innovation, and growth. The region leads the way in high-tech manufacturing in NY, and thanks to recent funding for STSA, it now houses comprehensive hardware accelerators.

Answers to Common Questions:

Q: My company is an S-Corp or an LLC that elected partnership taxation, so gains or losses flow through to my personal taxes. Are these taxes eligible for an exemption?

A: Yes! Pass-through gains are eligible for corporate tax exemption. So, if your LLC or S-Corp is less than five years old, has less than $2m in revenue, and is generating income, there could be a pretty significant financial benefit to owners by joining a STSA incubator.

Q: Can I start with Hot Spot tax benefits and then move into START-UP NY later?

A: Yes. The Hot Spot program is designed to support companies starting and developing in certified incubators. A company then has the option to apply for START-UP NY once they are at a point in their development where they can predict and quantify future job growth. For a comparison of Hot Spot and START-UP NY tax benefits, see this post.

Q: If I meet the above criteria, am I guaranteed tax benefits?

A: No, it is ultimately up to the NYS Department of Taxation and Finance on whether or not your company receives tax benefits.

Q: Are you my lawyer or tax advisor?

A: No! You should consult your own advisors to understand exactly how these programs might impact your own tax situation.

This is the second in a 3-part series on tax benefits by Marketing & Communications Associate Kristi Krulcik to be published throughout February and March. To stay up-to-date on new resources from the Southern Tier Startup Alliance, join our email newsletter.